- Empty cart.

- Continue Shopping

Gold rates climbs as UK, Japan mull restrictions

- Posted on

Luxe

- 0

- Categories: Financial News / News,News

Globally, gold prices climbed to their highest in eight weeks on Monday, holding above $1,900, as global COVID-19 cases spiked and countries pushed for more lockdowns despite vaccine rollouts.

NEW DELHI: Gold and silver futures prices in the domestic market traded with gains on Monday as coronavirus cases continued to surge forcing many countries to mull tougher restrictions.

Global coronavirus cases continued to climb, with British Prime Minister Boris Johnson hinting at tougher lockdown restrictions, while Japan considered declaring a state of emergency for capital Tokyo and surrounding areas.

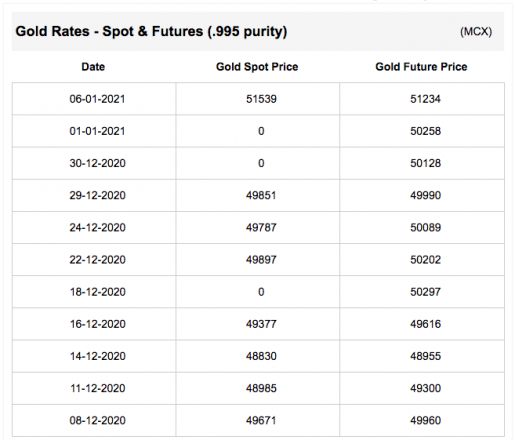

Gold futures on MCX were up 1.23 per cent or Rs 616 at Rs 50,860 per 10 grams. Silver futures added 2.21 per cent or Rs 1,504 to Rs 69,627 per kg.

The dollar index remained weaker against rivals on Monday, making gold cheaper for holders of other currencies.

In the spot market, Gold was marginally down Rs 20 to Rs 49,678 per 10 gram in the national capital on Friday, according to HDFC Securities. Silver also declined Rs 404 to Rs 67,520 per kilogram.

Globally, gold prices climbed to their highest in eight weeks on Monday, holding above $1,900, as global COVID-19 cases spiked and countries pushed for more lockdowns despite vaccine rollouts.

Spot gold rose 0.8 per cent to $1,912.71 per ounce by 0102 GMT, its highest since Nov. 9, while U.S. gold futures climbed 1.1 per cent to $1,916.40.

SPDR Gold Trust , the world’s largest gold-backed exchange-traded fund, said its holdings rose 0.08 per cent to 1,170.74 tonnes on Thursday.

Physical gold demand remained largely muted across top Asian hubs last week as holidays kept buyers at bay.

Silver gained 2.4 per cent to $26.98 an ounce. Platinum gained 0.6 per cent to $1,075.15 and palladium rose 0.6 per cent at $2,461.95.

By ETMarkets.com, Tuesday January 5th, 2021 12:46 PM

Like? Share it with your friends

Luxe

all author postsRelated posts

Gold and silver start 2021 on a high

- Posted on

- 0

Gold: A ‘must’ have asset in a portfolio

- Posted on

- 0